Prime Central London Investment: Part 2

Welcome to part 2 of our series on investing in the Prime Central London property market. In part 1 we looked at how the PCL recession looks anomalous in terms of its length and in the context of vast amounts of quantitative easing.

Here, we are going to expand on this research with some additional insight from Ludgrove Property that investigates how PCL property compares to other assets and investment opportunities.

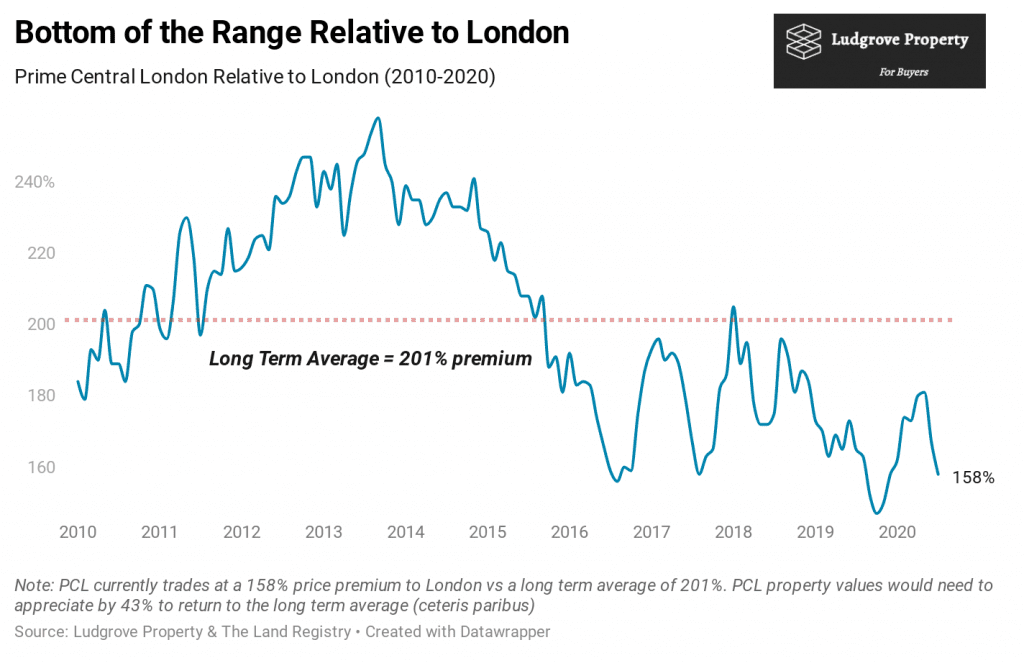

PCL values are cheap relative to London

PCL is trading near the low of its 10-year trading range versus the London property market, offering considerable value for those looking to switch out of the mainstream London market into PCL. Extremes in the ratio tend to offer good buy/sell signals and the fact the ratio has bounced off the 155-160% level three times in the last four years suggest a bottom may already be in place.

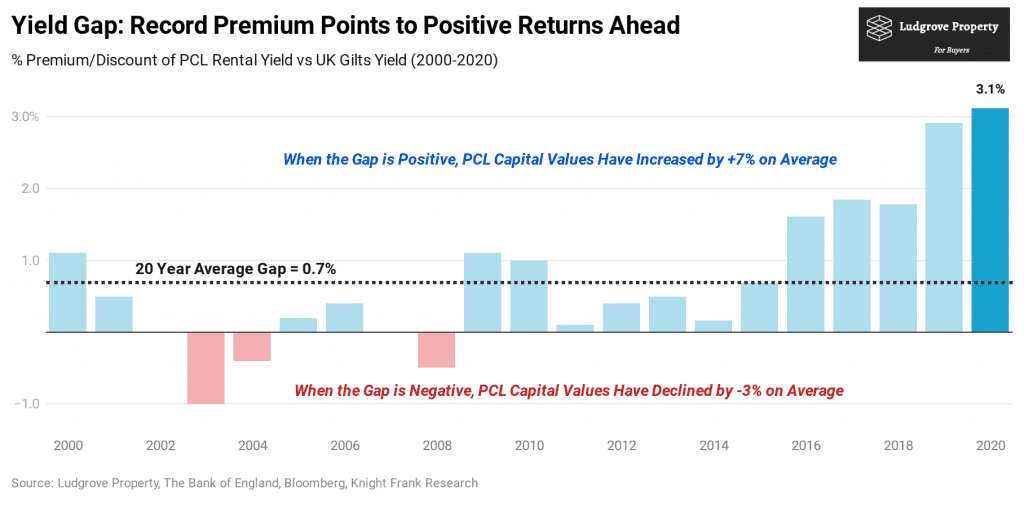

PCL is the cheapest on record relative to UK Gilts

Commonly used as an indicator by professional real estate investors to indicate the opportunity cost of owning property, the spread between the average PCL rental yield and risk-free UK Bonds (Gilts) is showing extreme value trading at a 20-year high. Separate research by Ludgrove has shown that historically when the spread between PCL rents and Gilts has been positive, the average PCL capital return has been +7% p/a and when the spread has been negative, capital values have declined by -3% on average.

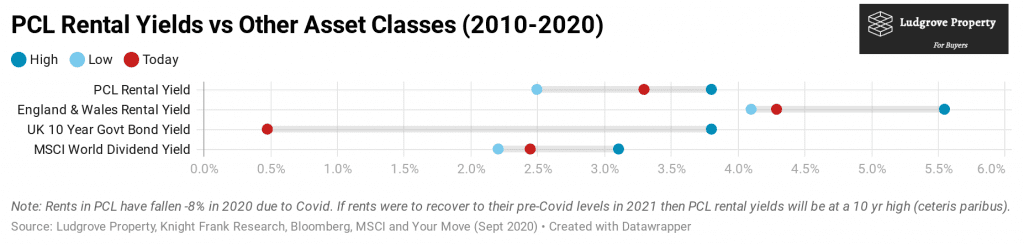

PCL is cheap relative to other assets on a yield basis

PCL rental yields are trading at the upper end of their 10-year range and this compares favourably with rental yields in England and Wales, the MSCI World Equities Dividend Yield and UK Government Bonds – all of which are trading at or near 10-year lows. PCL therefore offers relatively good value compared to other assets.

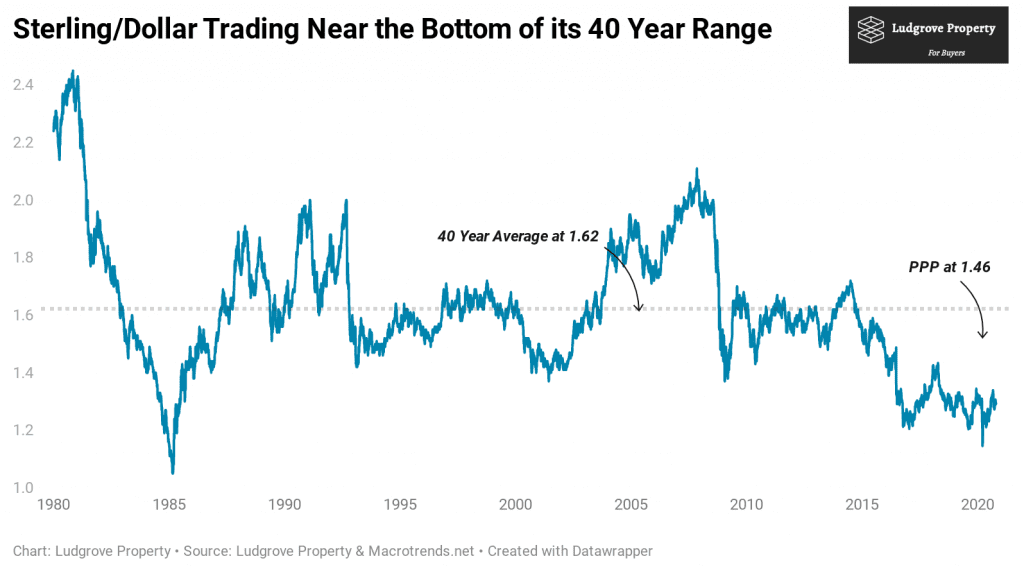

Sterling offers additional value to overseas buyers

Despite the recent rally, Sterling still trades near a 40-year low against the Dollar making UK assets attractive to overseas buyers. And it is not just US Buyers who are well placed to benefit from Sterling weakness, but also the large number of Dollar-pegged regions that favour central London investment properties such as Hong Kong, Malaysia, Singapore, Qatar, Bahrain, The UAE and Saudi Arabia. Historically bouts of Sterling weakness have led to surges of overseas buying in PCL and it is interesting to see how troughs in GBP/USD in 1985, 1993, 2002 and 2009 preceded significant gains in PCL values.

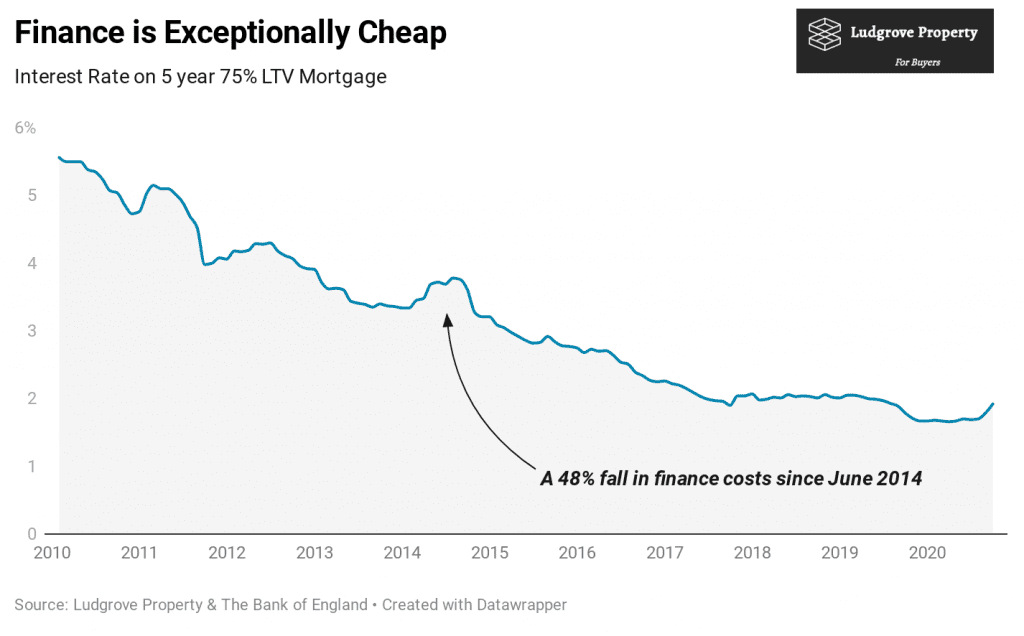

Mortgage costs are exceptionally low

Finance is cheap with mortgage costs having fallen to record lows. It is also noteworthy that over a period when finance costs have almost halved there has been negative real terms growth in PCL – something that is wholly incongruous with other assets.

Looking at this research, it is apparent the PCL property market is anomalously cheap and offers homeowners and investors an exceptional buying opportunity. PCL is cheap relative to the mainstream London market and other assets including equities and bonds, areas of investment that are not frequently compared. Finance costs are exceptionally low and the nearly 40-year low in Sterling/Dollar offers overseas buyers one of the best PCL buying opportunities in decades.

Stay tuned for more research in our investment series in partnership with Ludgrove Property. Ludgrove is a research-driven Prime London property buying agency, sourcing properties for homeowners, investors, family offices and developers. More information on Prime Central London Investment can also be found in part 1 of this blog. Also, sign up for our newsletter at the bottom of our website to get alerts directly to your inbox.